In trading crypto normally corrections often occur, this can be seen from the bearish side candlesticks. You can avoid buying at a higher price (before the decline).

So, on this occasion, VCGamers will share a few things about bearish candlesticks in the crypto world so you don't get stuck. What should you know? Please refer to the explanation below.

List of Bearish Candlesticks in Crypto

As the name suggests, a bearish candlestick is a candlestick pattern that traders can use to predict prices from rising to falling.

Bearish Harami

Bearish Harami is a double candlestick pattern which indicates a possible reversal of the price movement. In this pattern, the first candle is a long Bulls candle followed by a short Bears candle. Bear candles can also come in doji patterns.

The point is that the Bears candle must be inside the Bulls candle body, while the Bears candle price is formed in the GAP so that it is not the same as the Bulls closing price.

Dark CloudCover

Like the Harami, in this black mask, the open price of the bearish candlestick is the GAP of the closing price of the Bulls candle.

The body of the Bears candle also closes in the middle of the Bulls candle, indicating that the sellers have started to reign, so the future will be stronger from here.

Evening Star

Similar to the previous two patterns, the Evening Star pattern starts with a long strong Bulls candle (small wicks above and below) which continues into a short candle and is followed by a long Bears candle, which is at least about the same size or larger than the previous Bulls candle.

A small candle in a GAP can be made from the closing price of a Bulls candle, but that is not possible (without a GAP), so this small candle can be a Doji, Hammer or Pinbar candle.

Shooting Star

A Shooting Star is of a particular type, where the first candle is a long wild candle, which continues with long and short upper wick candles (may look like an inverted hammer).

The Shooting Star is a strength signal of seller behavior when the price is trying to move up, which can also continue as an evening star that will confirm the next signal confirmation.

Also read: The Easiest Way to Read Crypto Charts

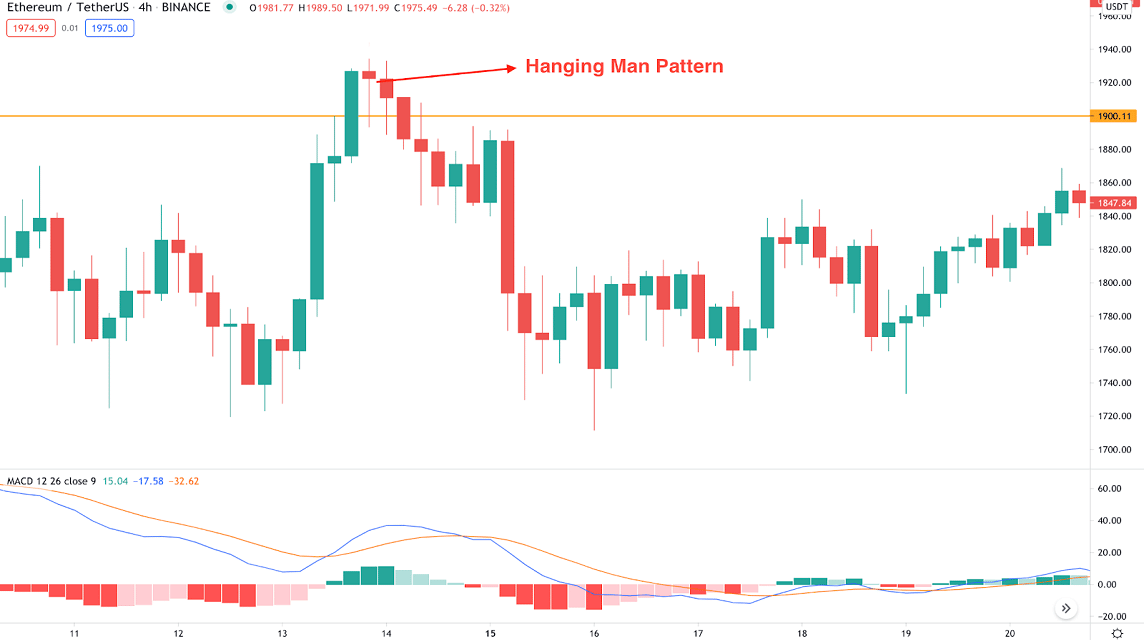

Hanging Man

In contrast to the other patterns above, Hanging Man is a bearish candlestick signal formed by one type of candles like the image shape (hammer type, long wick down and small candle).

This indicates an attempt to exceed the sales force over high pressure, thus providing a signal for the reintroduction of sales that will make it lower, the rest depends on the situation whether there is interference or inability to support. strength.

Also read: Daily Crypto Trading Tricks to Make Money Every Day!

So, those are some of the most popular bearish candlestick patterns used by crypto traders to understand the market before entering.