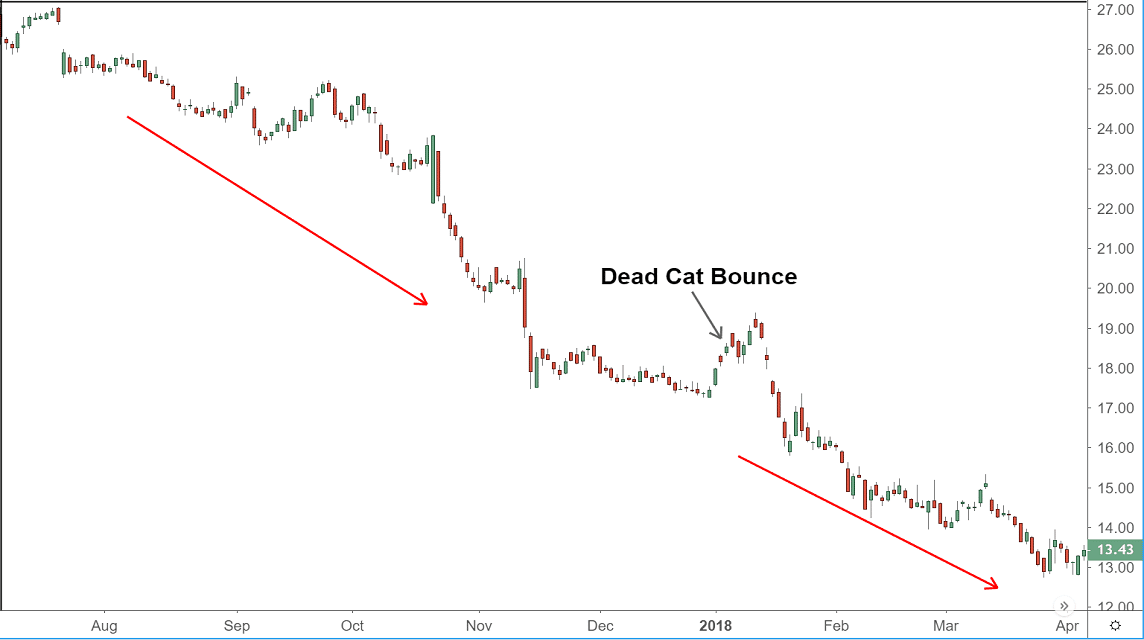

Dead cat bounce is one of the most commonly used terms in the stock market and crypto assets. The phrase refers to an event when traders and investors are trapped in a positive market sentiment for a while in a condition bearish.

How long this trap will last cannot be determined or estimated. As a result, the pattern can take days or even months.

Dead Cat Bounce Is?

Dead cat bounce is a temporary price increase that will be followed by a downtrend. This term has similarities with reconstruction technique (TR).

TR is an increase in an asset that occurs only temporarily after a decline. However, many experts consider this principle to be worse than TR, because the gains that occur cannot last more than one day.

This process occurs when there is a temporary or short recovery, when there is a long failure. These are called false signals and cannot be used as indicators to gauge whether market conditions will improve.

This is because a sudden increase in price can last for a while, before a larger decline in the future.

How to Overcome Dead Cat Bounce

The way to deal with dead cat bounce is through three steps that will take place. At first, the price will be very low for some time.

Then, the second level, later, the price will suddenly increase, which may look like a downtrend. Eventually, the bulls returned, falling lower than the previous low, and continuing to follow the decline.

Traders expecting profits can be fooled by the significant drop in traps in this market, giving the illusion of a negative effect.

However, the pattern is only a response to long-term market stalls that do not indicate significant market changes.

Also read: Do This When Crypto Bearish Occurs

Causes of Dead Cat Bounce

The cause of dead cat bounce is that it often appears for several reasons, from point to desire. This behavior reflects the general belief of investors that asset prices will recover soon. Often, investors may think that cryptocurrency prices has decreased.

This causes investors to buy more properties. This results in a trap, when the amount of financial income leads to multiple resources, which leads to the end of the price value.

Other factors causing dead bodies may be due to details of customers and income and some. Buyers and investors buy assets when prices fall in the hope of making small profits by taking advantage of fluctuations throughout the day.

Apart from that, the reason for this pattern can also be triggered due to price changes in the crypto market which is vulnerable with new news and speculation around the market. Any negative news can push the price down and positive confirmation can push the price up.

Also read: How to Invest Crypto When Bearish for Beginners 2022

Sudden interest in any crypto asset from such news can make traders buy more crypto assets. As a result, the price rises suddenly until the trader decides to sell at the initial opening of the trading position.