Inside bar candle patterns often appear on charts, but not all of them can be considered useful. This is because it takes a lot of hard work to find values in good bars.

In trading, we recognize various patterns price action which indirectly shows the direction of the next price movement.

This type of price movement often occurs from time to time so traders/investors can use it as a factor in making decisions.

Definition of Inside Bar Candles

Inside bar candle is a price pattern with two candles. The first large candle is called the main candle while the second, smaller candle is called the stem. The high and low of the second candle are not higher or lower than the first.

Therefore, the size of the second candle is smaller and neither higher nor lower than the first candle. The types of candles within it can appear at any time and the master bar can not only follow it in bars, but many bars at the same time.

Inside bar pattern candles also shows that bulls (buyers) and bears (sellers) are also strong, so market conditions are not good. Therefore, it is important for crypto traders to know and understand this principle.

How to Know a Good Inside Bar Candle

Inside bar candles are believed to provide strong and valuable signals if they can be traded properly. This arrangement is considered to represent the consolidation process after the big move, so that it can provide the right opportunity for customers to enter and make another big move.

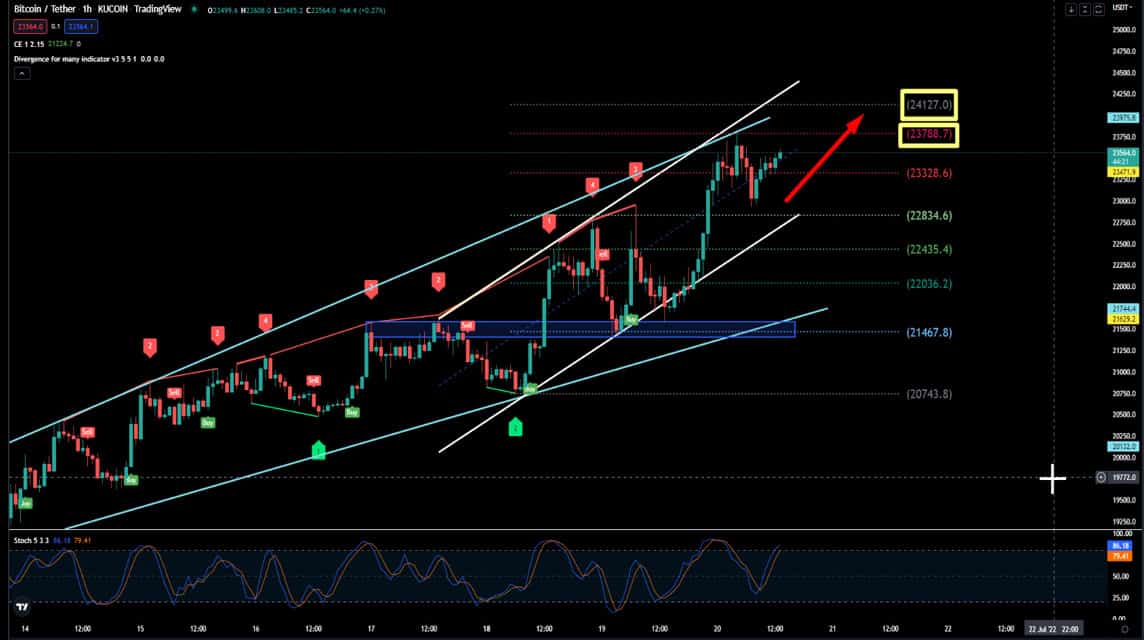

View From Time Frame

Judging from the time frame, the profit sign on the bar chart must be present on the daily chart and more. It is not recommended to look for bar values any time below the daily. This is because there is a lot of noise in a short period of time and it creates a signal from inside the room.

According to eLearnMarkets, In the long term bars are more important as they take longer to build and add more participants to the market.

Based on Market Trends

Even though it shows a selling combination, the inside bar candle is the best for trading the popular market. So, if market conditions are sideways or bearish, don't use the inside bar as a trading reference.

However, the combination shown on the Inside Bar has a much more important role if it occurs in the midst of a strong movement.

If it is found on the bar on the side of the market, then it cannot be regarded as a combination of methods, but who supports the position of some of the instructions is not clear.

To find out whether the current price trend is still strong or declining, you can use the help of ADX or other indicators that can check price trends. Apart from that, you can also check it via Price Action.

Also read: Get to know VCG Token: Legal Crypto Asset with Tens of Thousands of Holders

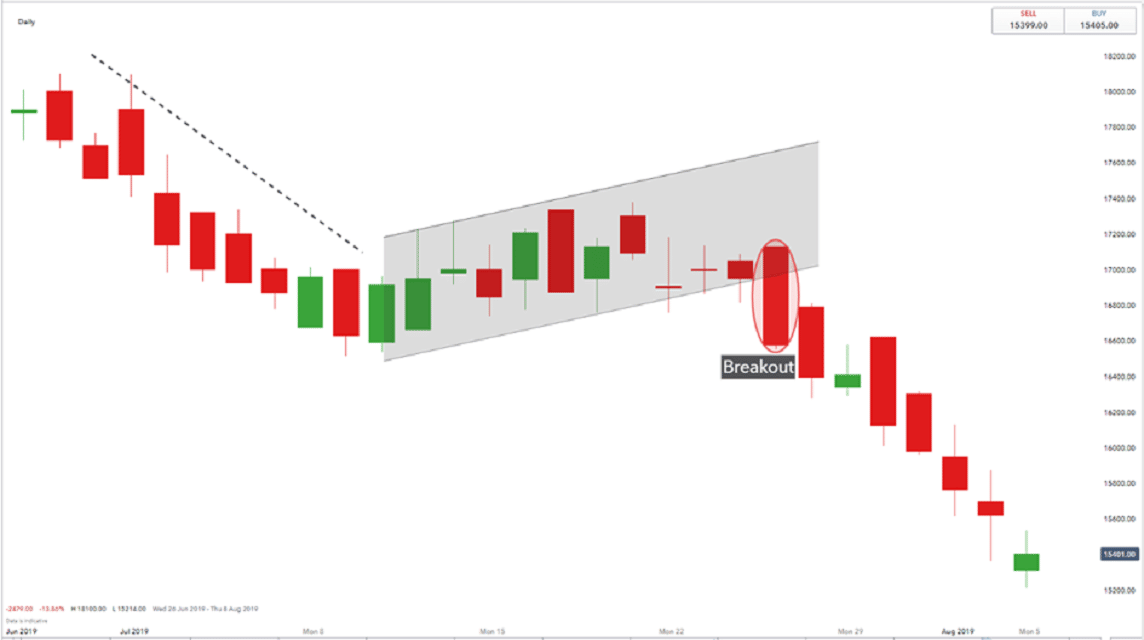

During Breakouts

As discussed in the previous section, a positive value on the bar is an indicator that convergence between systems is still strong. Therefore, the price must continue to follow the trend when an Inside Bar is formed.

To ensure the continuation of the trend, confirmation of a breakout inside the bar is a signal that we should pay attention to. Theoretically, the price breaking through the Inside Bar zone signals the end of the consolidation phase and the market's willingness to continue the previous trend.

Conservative traders wait for a candle when the inner bar closes to support a bullish formation supporting an uptrend. On the other hand, aggressive traders tend to be quick candles when the internal bar exceeds the parent bar. Some of them rely on the High Inside Bar to determine the entry level.

Both have advantages and disadvantages that can be adjusted according to your risk appetite. If you are the type of trader who prefers to be careful and careful, it is best to follow a consistent trader's strategy to make sure the candle closes first.

On the other hand, for those of you who like to take risks, aggressive trading habits can be right because it can prevent you from being late in taking a position when the price has passed High Mother Bar.

Trading in a candlestick pattern like Inside Bar seems easy. However, different rules and procedures must be taken into account so as not to explain the symptoms.

Also read: The difference between Crypto Coins and Tokens and Their Effect on Prices

For additional info, you can buy VCG Tokens as your investment asset or trading asset. This token is a crypto token released by VCGamers as a medium of exchange on Ranverse.

For those of you who are curious updating VCG Tokens, just look at VCNews!