staking is one way of depositing in the crypto world. Where, you can get the interest that you have saved. Here's a brief explanation.

Like many things in crypto, staking can be a complicated or simple idea depending on how many levels of understanding you want to unlock.

BFor many traders and investors, knowing that staking is a way of getting rewarded for holding a particular cryptocurrency is key. But even if you just want to earn staking rewards, it's a good idea to understand at least a little bit about how and why it works the way it does.

Cryptocurrency Project that staking offers is possible to earn as much as 20 percent annually from holdings. While 20 percent is a fairly high return, the average return is around 5 percent.

To put that in perspective let's say a cryptocurrency offers 10 percent APY to stake. You can stake $10,000 worth of that crypto and you will be paid $1,000 in free crypto for a year. Just to basically hold that asset.

Staking is a great addition to the cryptocurrency space for a number of reasons. Crypto staking adds familiarity, engagement and rewards to the ecosystem, making the investment even more worthwhile.

How Staking Works is Locked

If the crypto currency you have allows for staking. Current options include Tezos, Cosmos, and now Ethereum (via the new ETH2 upgrade).

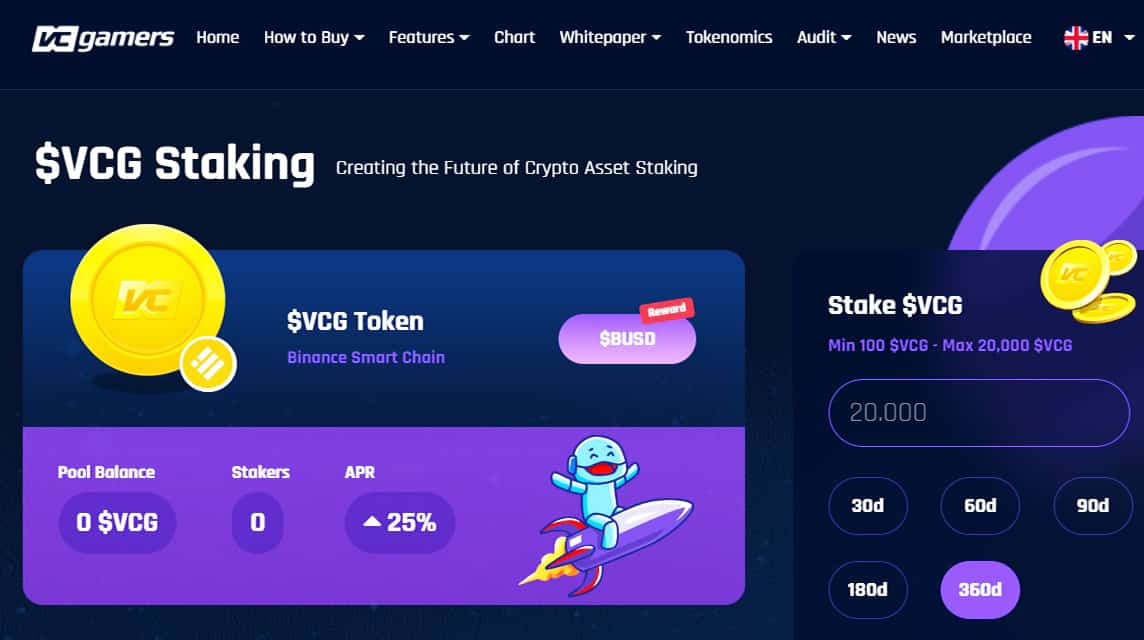

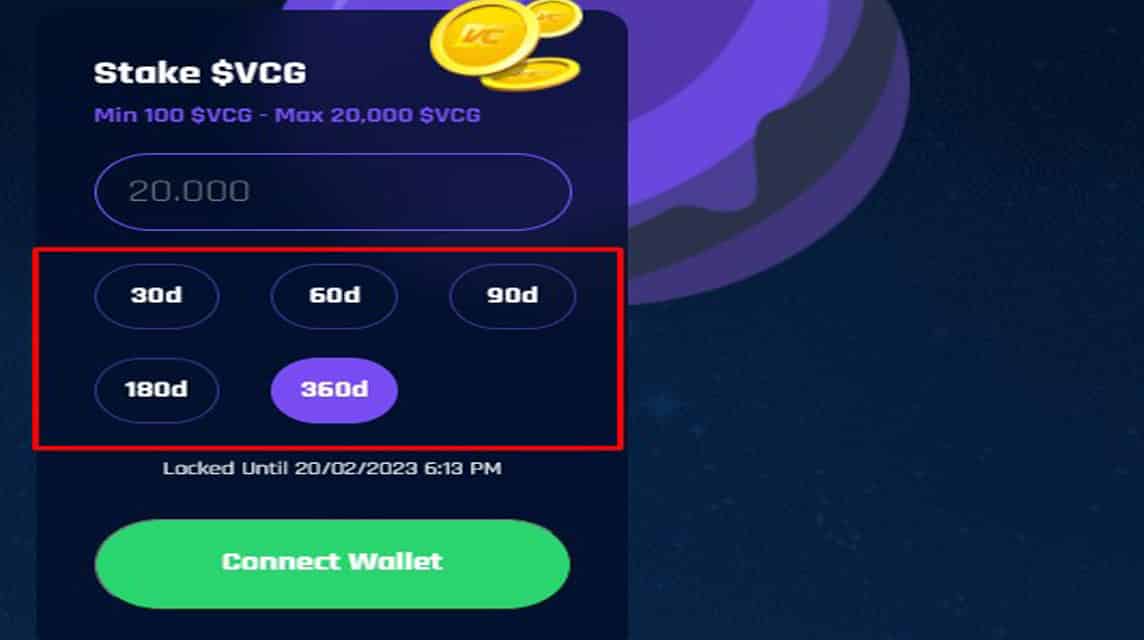

You can "stake" multiple holdings and earn a percentage reward over time. This usually occurs through a “staking pool” which you can think of as similar to an interest-bearing savings account.

The reason your crypto gets rewarded when staking is because the blockchain makes it work. Cryptocurrencies that allow staking use a “consensus mechanism” called Proof of Stake, which is their way of ensuring that all transactions are verified and secured without a bank or payment processor in the middle. If you choose to save it, be part of that process.

Two Types of Staking

Broadly speaking, there are two ways to stake, you can delegate or you can validate. Staking is delegated a lot easier for the average crypto user and it's what people generally refer to when they talk about staking.

Becoming a validator requires highly technical knowledge of cryptocurrencies, special equipment, a large number of cryptocurrencies and the strong internet that you will find in data centers. Therefore, it is usually an institution that acts as a validator.

Meanwhile when you delegate, you just lock crypto funds with a recognized validator and reap the rewards with minimal effort (in return the validator will take a small portion of the proceeds).

With either form of betting, you get a return on investment in the same asset you are betting on. So, if you have staked Cardano, then you get rewarded at Cardano.

Staking Benefits

Do you like to generate passive income on a monthly, weekly or even daily basis?

There are many reasons to stake cryptocurrency, but for most people, the staking reward will always be first and foremost.

This is especially useful for investors who only own crypto. Might as well earn on that crypto. The benefits of staking are;

- You help secure the network.

- Helping investors take a long term approach, which generally pays off in crypto.

- You don't need any equipment.

- It doesn't require anywhere near the energy output of mining Bitcoins.

- Staking is a great way to learn about the crypto ecosystem.

Also read: Get to know Crypto Airdrop: Understanding and How it Works

With staking there is almost always a lock-in period you need to watch out for. It generally takes a few days to regain access to crypto or even a month.

In extreme cases (such as transition Ethereum to ETH 2.0), you lock up coins for months or even years. This is one tradeoff.

It doesn't matter if the market is falling and you want to get rid of the asset you are betting on. You must wait until the agreed duration before regaining access to your funds.

Some services exist which eliminate the technical hassle by staking coins on proof blockchains share. They simply automate the technical process of starting the staking mechanism.

Since proof of stake is relatively new to the world, it is still a technically involved process that requires some technical expertise to get started. Some projects make the process very simple, by adding custom keys directly to their core wallet.

Other projects have yet to build user interfaces to simplify the process, creating the need to risk service providers.

Stake is a way of deposit which is very similar to having a savings account at a bank. Banks make it possible to get a percent of the holdings on a regular savings account.

This is because banks are actually lending money behind the scenes. The interest rate they give you is their way of compensating you for keeping money in their bank.

Also read: 5 Benefits of Staking $VCG Token

Therefore, the concept of staking is not so foreign to you every day. The cryptocurrency world tends to invent new terms for old concepts.