A falling wedge or also known as a descending wedge pattern is a price chart pattern that serves to indicate when the trading day will begin.

Just like the rising wedge pattern, the falling wedge pattern is often used by paras traders use technical analysis. For more details, see the following article!

Definition of Falling Wedge

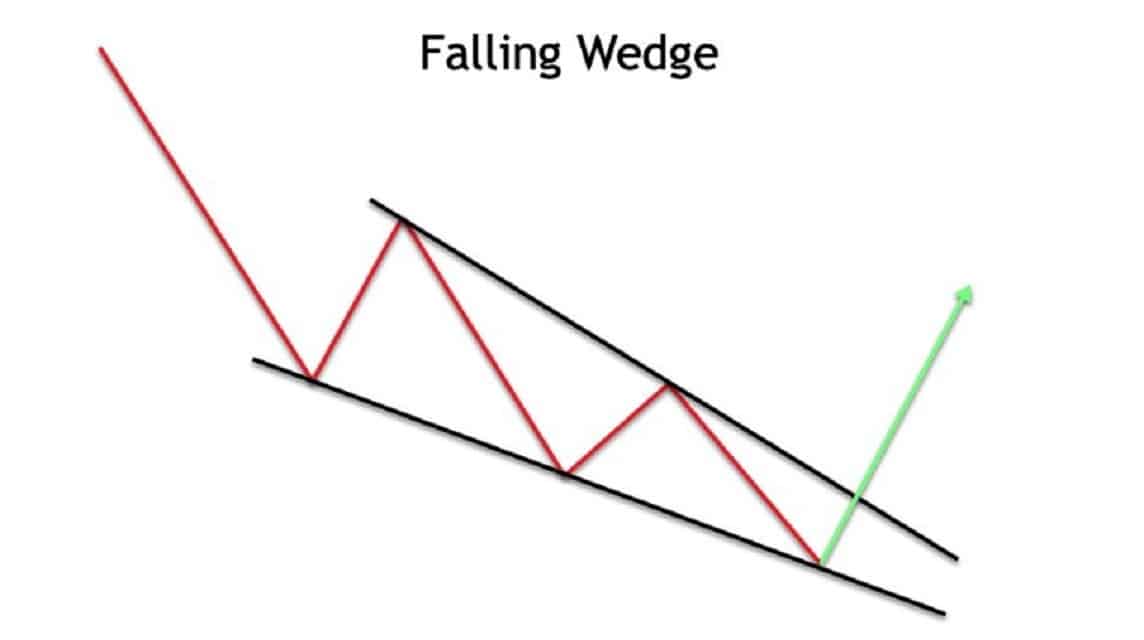

The falling wedge pattern is a pattern that is formed when the price rises or reverses between two descending lines and converges. This type of pattern is often seen at the end of an asset price downtrend.

In addition, this pattern will later be made using bearish stops and support lines. However, you can still see that the resistance movement is getting stronger in terms of patterns and support lines.

This pattern is characterized by the falling candle pattern itself of a short candle on a falling price chart. In which, he identified that the uptrend is slowly being formed by the buyers.

Also, if the set price crosses the upper trend line, a reversal will occur (the asset price will increase). As previously explained, the descending wedge pattern is an example of a bullish pattern on the market price chart.

When this pattern is combined with a rising wedge, both of them will determine whether there is a change in trend direction. Apart from that, these charts also allow traders to take a bit more time and start entering the market.

This pattern is often seen at the end of a downward trend in an asset's price and this pattern will be used as a downward support and resistance line. However, when compared to the pattern of the support line, the movement of the resistance line is relatively weaker.

A falling wedge is an example of a bullish pattern on a market price chart. When combined with the rising wedge pattern, both of them will show a change in trend direction. In general, this principle is considered revolutionary, although there are places where it can be helpful to move forward rather than reflect.

On an upswing, this pattern will appear to continue upward. This allows traders to take long positions in the market. Meanwhile, during a downtrend, the downward pattern indicates an upward retracement.

This principle allows traders to gain long-term exposure and allows investors to enter the market.

Also read: Getting to Know Privatekey in the Crypto World

How to Use a Trend Falling Wedge When Trading

In the end, falling or rising is a pattern that you can use to determine your strategy when trading crypto assets in the market.

Thanks to these two methods, customers can determine the right time to open a position and the stop loss value. A stop-loss is a limit order that is placed in advance to prevent losses in the event of a sudden price movement during a trade.

Apart from that, traders and investors can also use this model to determine the profit or even the risk that will be faced when deciding to trade.

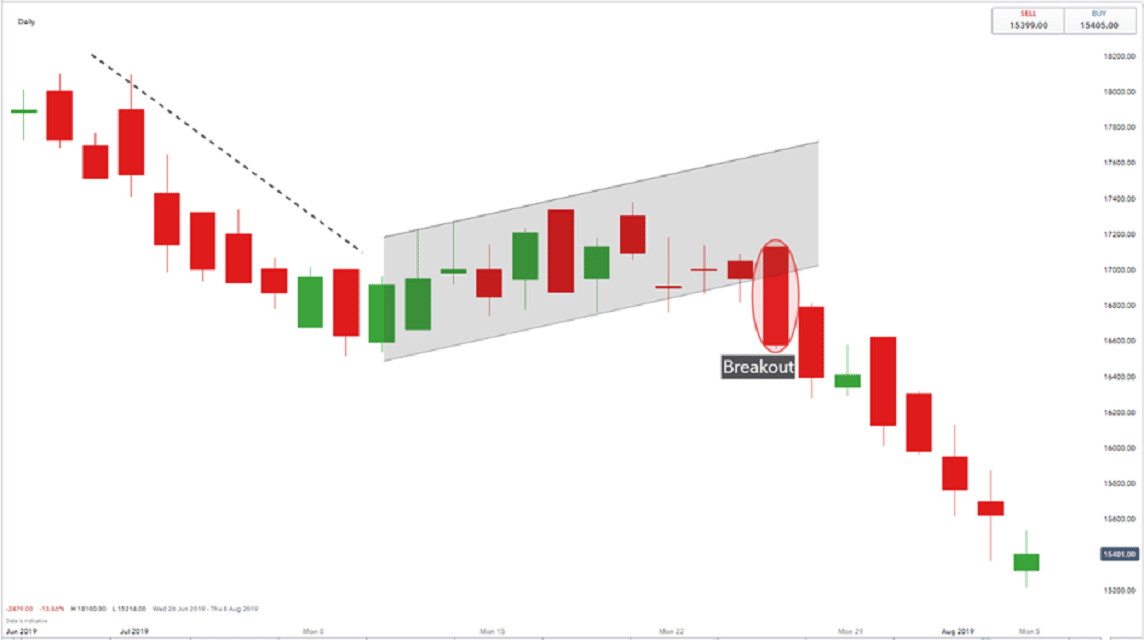

Before opening a trading position, some experts advise traders to confirm the pattern by waiting for the breakdown to appear price movement charts in the market.

Therefore, if the price has crossed the upper level during the downward movement, the expert advises sellers to buy crypto. Meanwhile, when the price breaks the descending line during the increase, customers pay to sell assets or close their positions.

For other methods, as mentioned above, the customer can set profit or stop loss at the highest price or above the previous support level. However, if it turns out that property prices continue to decline, then the seller is forced to sell the property.

Not all indicators and standards work in the same way. Of course, some are better suited to certain asset classes than others.

However, the falling wedge is the most commonly used in cryptocurrency assets and can be a reliable indicator of the incoming exchange rate. Depending on the purpose of trading, falling wedges can be found in various time frames from a few minutes to a whole month.

Also read: The difference between Crypto Coins and Tokens and Their Effect on Prices

Additional updates that you need to know about are VCG Tokens. This token belongs to VCGamers which you can buy on Indodax and BitMax.

The VCG Token itself is on the BSC network and ETH 20. Where you can use it as a medium of exchange in Raffi Ahmad's Ranverse.

Get it updating VCG Tokens the latest only on VCNews!