DEX or exchange peer-to-peer is a type of cryptocurrency exchange that occurs online peer-to-peer. So, how does DEX work? For those of you who are curious, please refer to the explanation below.

DEX definition

Decentralized Exchange (DEX) is a type of exchange and transaction peer-to-peer unique cryptocurrencies and digital assets. Unlike Centralized Exchange (CEX), DEX does not require a trusted third party or intermediary to facilitate the exchange of crypto assets.

The main goal of crypto is financial flexibility because it increases the economic freedom of people everywhere, regardless of who they are. DEXs are an important part of decentralized finance (DeFI). In fact, without a highly liquid DEX, DeFi will not achieve the massive growth it has.

How Do DEXs Work?

We know that dex complies with the rules of the brokerage chain and allows traders to hold their tokens. Now we'll dive in to understand how DEX works.

Auto Market Maker

You may already know that CEX uses legal documents to connect buyers and sellers. Dex can't do the same because the backlog requires a centralized team and technology to work.

In contrast, DEXs use an automated market maker (AMM), which is the principle that works and controls the process of making money.

AMM does not require members to interact because transactions are made via two matching token pairs. AMM does it against the money in the pool, so if you want to buy tokens, you don't have to look for any type on the sell side.

Founding father Ethereum Vitalik Buterin introduced the AMM concept to the world in 2017, after which dex works based on the original AMM concept, like UniSwap became a reality. If AMM is software code, it still needs to trace assets from one part to another.

Liquidity Pool

How will the DEX go next? A decentralized exchange is a smart contract or smart contracts executed on a crowd-matched token pool.

Crowdsourcing means that all the tokens in the liquidation pool come from different investors (LPs) in the crypto community.

LPs put their assets in the pool out of incentives. For example, they can earn attractive prizes, such as LP tokens, or trading fees by investing in liquid pools.

Also read: Understanding Defi Crypto, Beginners Must Know!

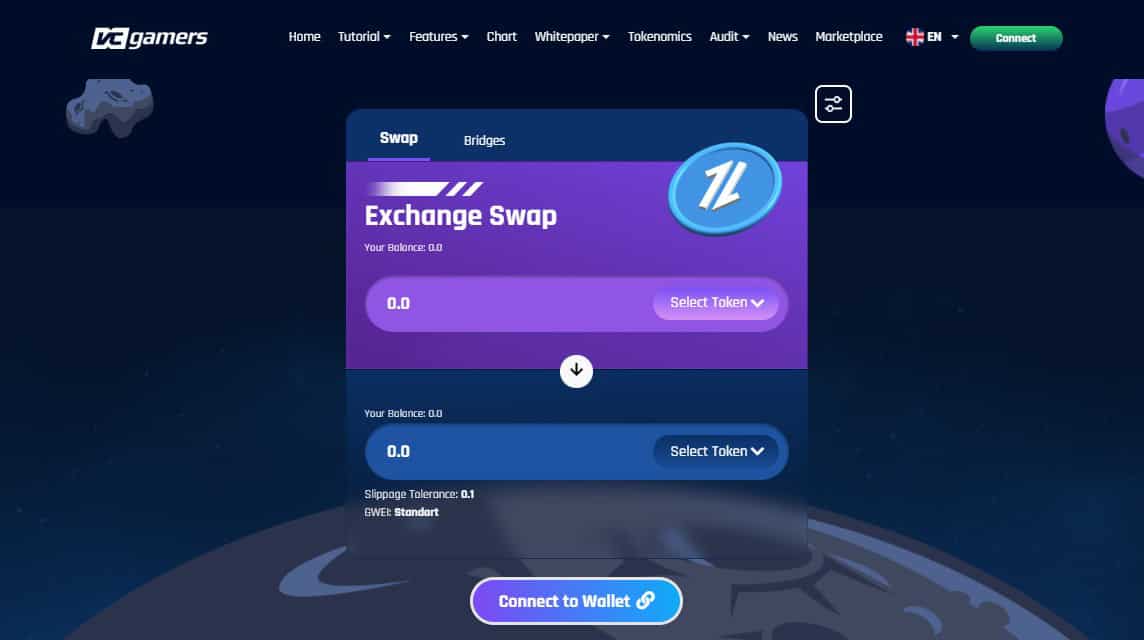

Swaps

The next revolutionary generation will no longer use legal documents to facilitate crypto transactions or set prices. However, the platform uses a liquid protocol to value assets.

In network peer-to-peer, transaction processing will work directly between users' wallets, a process called Swap. DEX services in this sector are valued by Total Value Locked (TVL), or the value of assets held in smart contract protocols.

Currently, the flexibility of Decentralized Exchange is still in the early stages of development, so users should be aware of this weakness. Especially for users who are not familiar with blockchain technology.

Also read: What the Rug Pull Scam Is: Definition, Types, and Signs

This is because users need to be familiar with external wallet platforms in order to interact with the DEX. Not only that, users also need to support their wallets by transferring fiat currency or crypto assets.