The presence of market research methods allows traders to predict future market price conditions, so that customers no longer need to predict prices accurately. One of the methods used is Fibonacci crypto.

Get to know Fibonacci Crypto

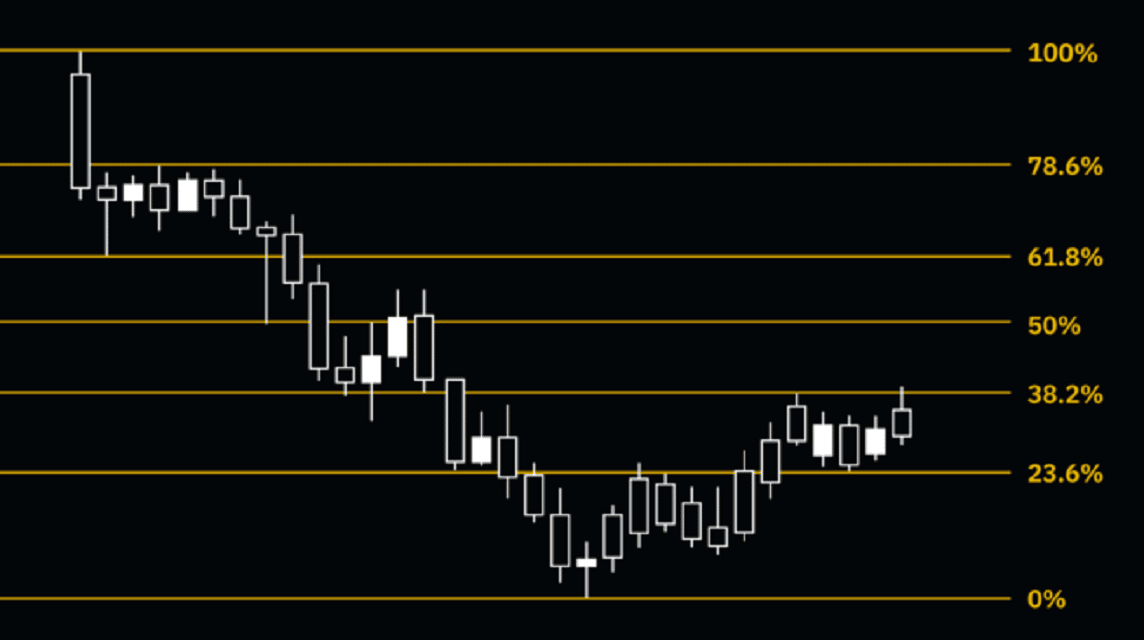

The Fibonacci concept is not only used in the world of mathematics, but also in the world of trading, one of which is Fibonacci crypto. Fibonacci retracement is an analysis tool that derives from the development of the middle number of numbers fibonacci.

You could say that Fibonacci retracements are not an indicator that can be used directly, but as a market research tool, chart entries require different measurement and analysis.

The analysis can also be different for each trader, because the trader himself determines the price levels that serve as reference points for drawing Fibonacci lines.

How to Use Fibonacci Crypto For Trading

For those of you who are still beginners and want to learn trading, please refer to some of the steps or how to use the Fibonacci crypto pattern so you can make money.

Determine the Support Level

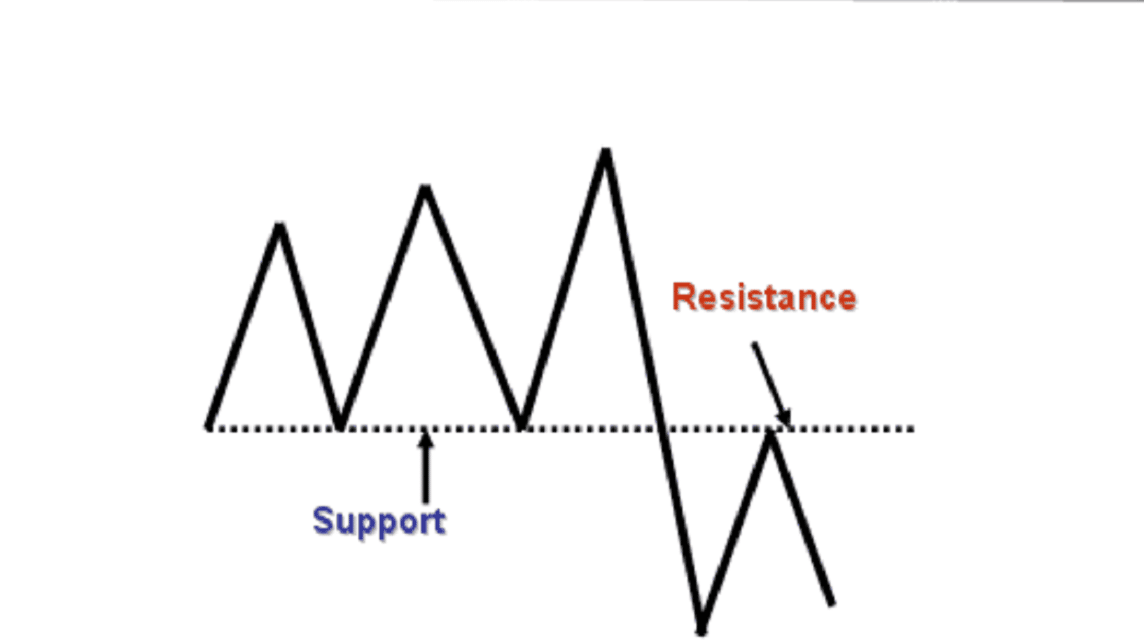

Before deciding on support levels, traders must understand what swing highs and swing lows are. A swing high is an uptrend as a candle that sits above trending prices over time, flanked by two other highs.

Meanwhile, a swing low is the lower candlestick of a price trend over a certain period of time, which is lowered by the decline of two high price points.

To determine support levels, traders can connect swing lows and swing highs using the Fibonacci retracement tool. Automatically, the support level will be formed by dividing the distance between the two points via the Fibonacci sequence.

Also read: The Best Video Graphics Settings For Valorant!

Determine the Resistance Level

Using Fibonacci retracements to identify resistance levels is no different from identifying support levels.

The difference is that the stop level decision is made by combining the high rotation point with the low point.

Then the resistance level will appear automatically according to the principle of Fibonacci ratios. By knowing the level of resistance, you can determine the best target to increase their trading activity.

In practice, traders often don't know which higher or lower to use. Of course, every trader has his own opinion and analysis.

There is nothing wrong with swing highs and lows, because in general they can be used as a basis for the five Fibonacci lines of crypto. Then, the Fibonacci retracement tool can be said to be valid or not if the price has returned and formed a new trend.

Fibonacci retracements are technical indicators that, when used correctly, can tell you exactly when to enter and exit the market with little risk of loss.

Although many traders find this process confusing, it can be beneficial if used properly and in the right situations. Although reliable, it takes time to get used to this tool.

Also read: How to Buy Crypto, Know These Things!

If not properly understood, it can be dangerous to use. This is why it is not recommended for traders to use it if you don't know exactly how to use the Fibonacci retracement method correctly.