This time, VCGamers is back to do the analysis BNB/USDT and BTC/USDT today, Wednesday 13th July 2022.

This analysis is to be carried out by taking into account the movement of the two assets.

In addition, to predict the movement of BNB/USDT and BTC/USDT.

Let's see the full review!

Also read: $VCG VCGamers Crypto Token Officially Launched, Check Out the Complete Info! Hooray!!! $VCG Token Passes CertiK Audit VCGamers Focus on Strengthening Fundamentals $VCG Token

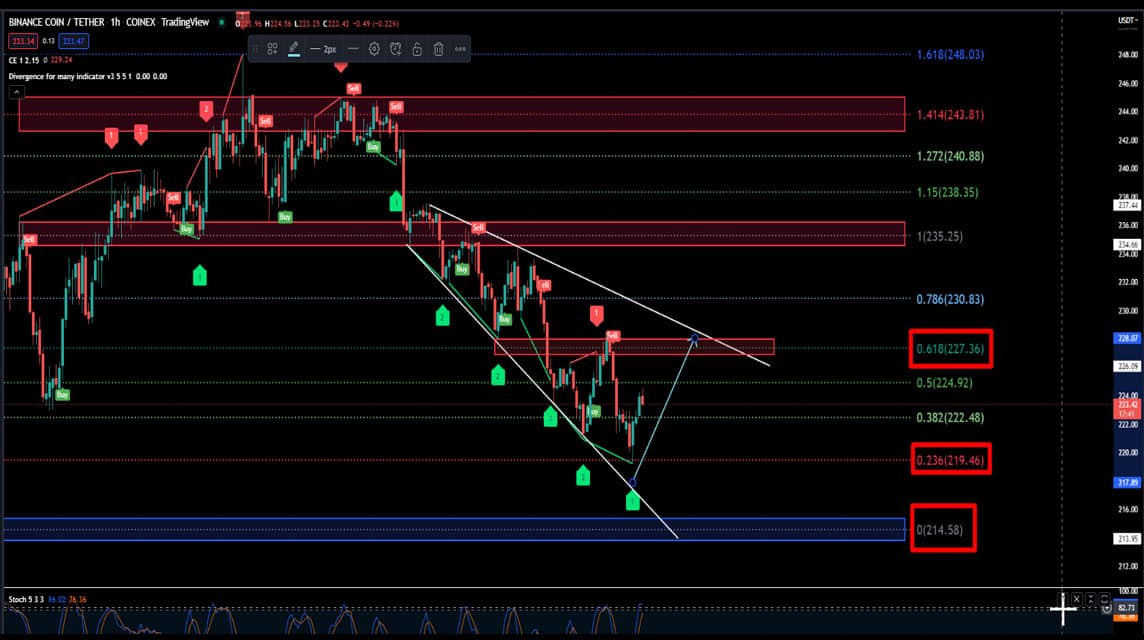

BNB/USDT analysis

Based on VCGamers' analysis, this afternoon's market is predicted to show that buyers have started to break out from seller pressure and are heading for resistance at the price of $227,- / $230,-.

This is supported by the Descending Broadening Pattern where the market moves towards the upper line range around the resistance price.

If you have reached this resistance, there is a possibility that there will be pressure from sellers on the market towards support at price $219,- / $214,-

Also read: How to Get Free Bitcoins on Indodax Try now! This is How to Buy $VCG Token on Pancakeswap How to Buy $VCG Token on Uniswap

BTC/USDT analysis

Today's BTC/USDT market is predicted that buyers have started to break out even though sometimes there are still obstacles from seller pressure. Currently, buyers are predicted to be resistant at the price of $19.827,- / $20.036,- / $20.292,-.

If there is resistance from sellers, buyers will be pressured towards support at $19.585,- / $19.237,- /$19.073,-.

Also read: Yeay! EIGER Adventure Coming to RansVerse Soon Selling Well, Hundreds of RansVerse Land Sold Out in 35 Minutes Collaboration with RansVerse, SBM ITB Students Can Study in the First Metaverse in Indonesia

To be known together, that crypto asset investment is a risky activity.

You can invest in crypto assets on Decentralized Exchange (DEX) and Centralized Exchange (CEX).

However, you must pay attention to the risks and benefits.

Therefore, we need to do in-depth research to find out how the fundamentals are crypto assets what you want to invest.

Apart from that, pay attention to a number of things before making an investment such as using cold money, understanding the project of each crypto asset to choose.

Make sure to always do your own research (DYOR) to minimize investment risk.